Certainly, pre-paid dent insurance, in theory, sounds like a good idea:

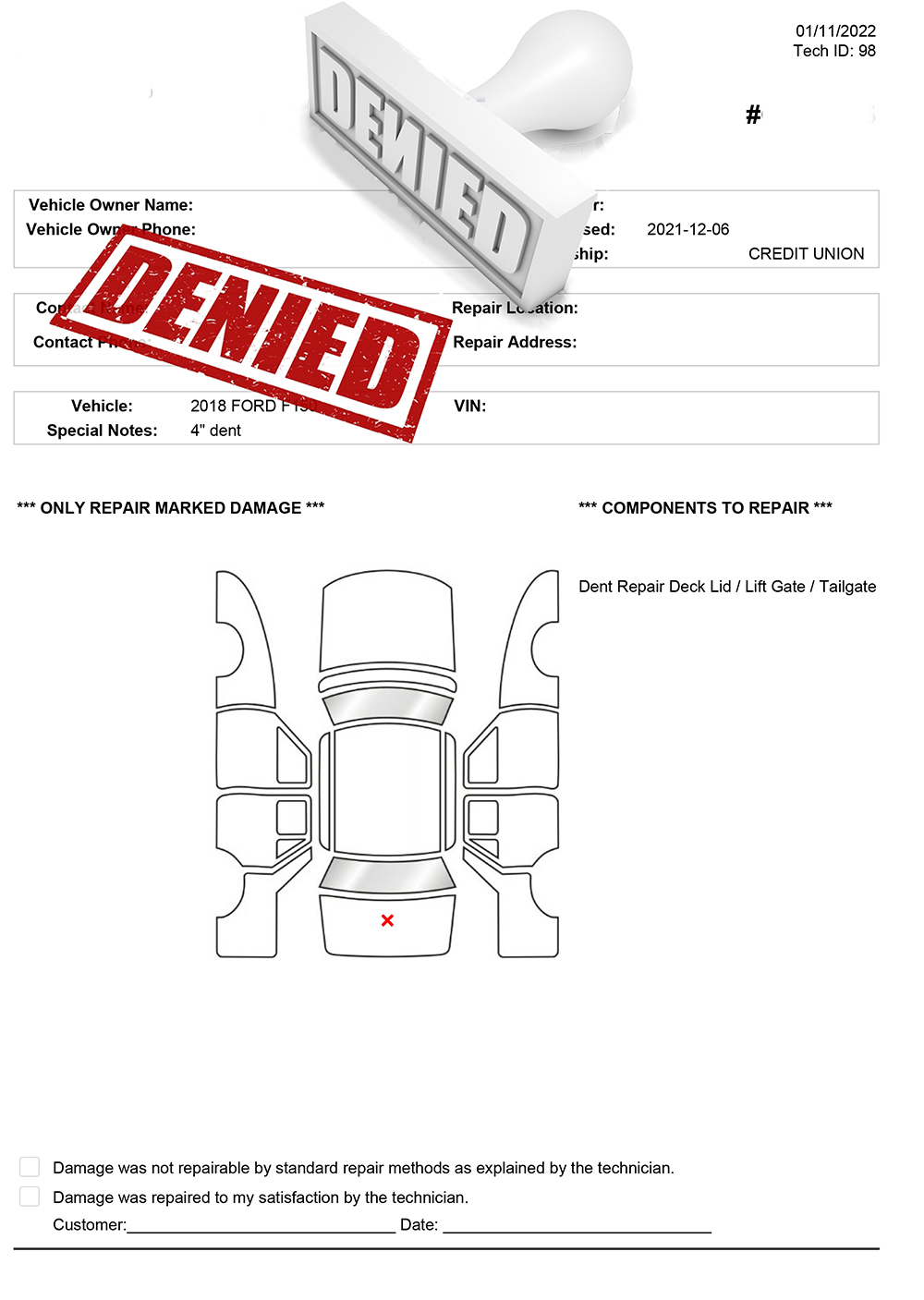

Limitations on Coverage: Pre-paid dent insurance has limits on the types of dents covered, size restrictions, and only allows minor soft dings with easy access.

Exclusions and Fine Print: Like any insurance policy, pre-paid dent insurance has exclusions, limitations, and conditions in the fine print that will restrict the coverage.

Potential Underutilization: If the vehicle doesn’t encounter many dents during the coverage period, the money spent on the pre-paid insurance might not be fully utilized, leading to a perceived lack of value.

Not Comprehensive: It doesn’t cover significant damage or accidents beyond minor dings. Major collisions or damage will require your regular insurance coverage.

Ultimately, whether pre-paid dent insurance is beneficial depends on the vehicle, the individual’s circumstances, vehicle use, and the specific terms and coverage offered by the insurance provider. It’s important for vehicle owners to carefully review the policy details, including coverage, limitations, and restrictions, to ensure that it aligns with their needs and provides comprehensive coverage for potential paintless dent repairs.

We have experienced that most everything is denied because of access, a chip in the paint, the removal of parts required for proper access it required, or the damage stretched. Usually, when we give our estimate they want to pay 1/3rd of the going rates or after we do the repairs after they pre-approved the repair, they have made us jump through endless hoops to get paid or just not paid, period. So we end up eating the repair or charging the customer and letting them seek to be made whole per the policy or by the dealer that sold them the policy.